Finest Seller Expert for 2020: Charges & & Features

Interchange-plus is the most clear as well as often lowest-cost design, yet some cpus count on tiered rates, while others may provide flat-rate rates to low-volume mobile organisations. Variables such as the age of your company, the kind of industry you're in, and even the kind of cards you process all element right into the Go to this site prices your merchant account provider will offer you.

How do you read credit card processing fees?

Small businesses can accept credit card payments by using an online merchant gateway like Stripe or PayPal, by setting up a POS system with a merchant account or by using a mobile card reader to accept credit card payments through a smartphone app.

Cash Money Application: Best for Person & Peer-to-Peer Settlements.

Rather, they operate a pay-as-you-go basis, as well as the expenses of maintaining your account are included in your handling charges. This type of setup is typically a lot more economical for little merchants processing less than $5,000 each month. There https://www.datafilehost.com/d/cbe36534 has actually been a demand for a less complex method due to the fact that the non-integrated approach can frequently lead to headaches for new eCommerce vendors. Under an incorporated approach, your vendor account company (or settlement services provider (PSP)) supplies you with a single product that incorporates as many of these different solutions as possible.

By using independent seller services providers to provide accounts, however, it increases its variety. If you want to approve credit history as well as debit cards from your clients-- and also basically every service needs to these days to continue to be affordable-- you likely, but not necessarily, need accessibility to a vendor account. You can think of a merchant account as a savings account that prolongs you, the merchant, a credit line. Square deducts its handling costs from the complete deal-- that consists of tax as well as pointer, not just the base quantity.

- The cheapest charge card handling for larger businesses is Dharma.

- Square is for you if you are simply getting begun as well as require an account swiftly.

- Basically, vendor providers have started offering round figure of capital to consumers for a future part of business's card sales.

- The sales department for every business need to be able to provide you a company answer on this concern.

Read our post on the very best high-risk seller account companies to see which vendor accounts are fit to this sort of company. All the companies we've profiled right here give exceptional service at an economical price, but some are much better matched to specific sorts of companies than others.

When establishing a merchant account, you participate in peripheral arrangements with these business. Some smaller sized card brand names, like American Express, are opt-in, implying that you decide whether or not you intend to accept them and also enter into their agreements. For our objectives, the Browse this site MSP is a sub-company that releases merchant accounts from a larger firm. The processor can establish a merchant account on its own using its very own sales staff and also advertising division.

Account Fees.

A vendor providers is said to be a straight processor if it supplies both the vendor account onboarding along with the processing solutions. Reputable and just huge business often tend to have the resources to do this. For the most part, an MSP establishes as well as maintains the merchant account, yet utilizes the services of various other companies to take care of the payment handling itself. It would certainly be convenient if everything associated with credit card handling were handled by a single, monolithic entity.

The most affordable online settlement cpu differs for each organisation based on the size of your organisation, the number of purchases you procedure, and also your ordinary purchase amount. Visit our guide on the cheapest bank card handling remedies to see which one might be appropriate for you. When picking a repayment processing remedy, it is essential to do the math yourself as well as contrast prices. The credit card processing business is infamously opaque, and also not all business have the very same type of charge framework.

7 Apps and Visitors for Mobile Bank Card Handling

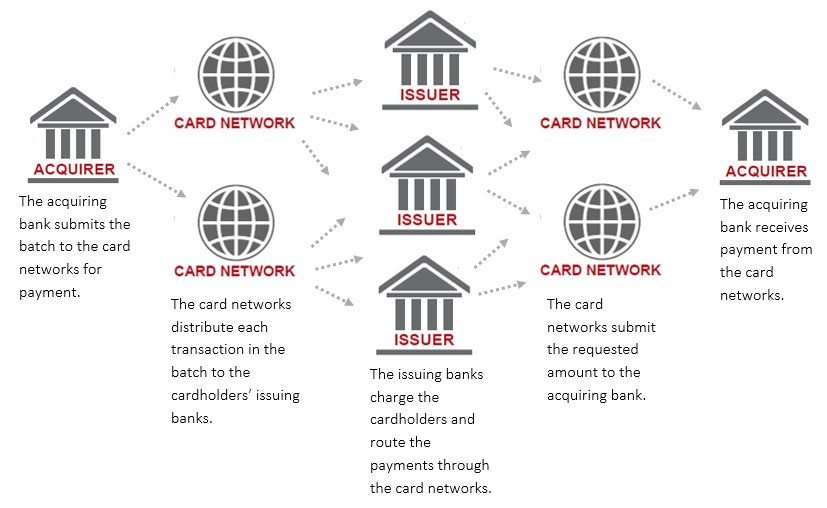

The prices, however, differ relying on the type of card and also purchase. Debit cards have much lower interchange charges than credit cards. Swiped deals have lower fees than keyed-in transactions. Your financial institution sends out the info from your charge card purchases to the issuing bank with the settlement processor in order to accumulate payment.

What is the cheapest way to take card payments?

The vendor also means the seller. The term ' vendor financing' refers Extra resources to the seller providing credit to the buyer. The word merchant can be used in a very general term to describe anyone who is selling something, or even a whole class of people as in 'merchant class'.

There are additionally some advantages to having your own merchant account. You can typically get better prices as well as much better customer care, as well as the chance of having your money held or your account frozen is reduced.

PayPal Qualities.

Is PayPal cheaper than Square?

Square's hardware offerings are cheaper than Clover, which gives it an advantage. Their hardware options are flexible and perfect for new and small businesses. Clover offers more flexiblity because it allows you to work with other payment processors, while Square requires you to use its merchant services.

Square is complimentary to set up as well as offers low-priced payment processing without regular monthly minimums or additional charges. With Square Payments, you easy pay purchase fees as settlements are refined-- that's it. Square also uses an entire collection of devices for developing a site and also handling your organisation, so every little thing is arranged under one smooth system. You'll pay 60 cents for every $20 credit card sale if your discount rate is 3 percent. A lot of service fee a regular monthly declaration cost, which ought to be around $10 or less.

- They are used by organisations to accept credit score or debit card payments with a point-of-sale system, web site, or on-line purchasing system.

- These kitchen counter credit card visitors have integrated receipt printers as well as keypads.

- A payment entrance is the innovation that produces a safe connection between your website or internet browser and also the credit card handling firm, securing settlement data for every charge card transaction.

When your organisation outgrows the restrictions of that strategy, it's simple to update to the next-highest level of solution. Shopify doesn't enforce any lasting contracts or charge any type of very early termination costs. Nonetheless, you can obtain a prices discount of 10% by spending for one year (or 20% for 2 years) ahead of time. Keep in mind that you'll need to obtain a quote from the company for details rates as well as fees that are available to your organisation. With very low account fees and competitive processing prices tailored to your Helpful resources company, CDGcommerce provides a wonderful combination of price and also worth.

Contact Us Regarding Our Merchant Solutions.

Various settlement handling companies advertise the lowest prices, as well as a lot of them have entirely various fee frameworks. Discovering the most affordable bank card processing is complicated, but can conserve your company hundreds, otherwise countless dollars every month.

There are no month-to-month or hidden charges for bank card handling. All fees are deducted prior to funds are moved to your connected bank account. https://www.scribd.com/document/454817074/318626-Cheapest-Charge-Card-Processing-Companies-2019 Credit card providers established the interchange charges on an annual basis. What you can negotiate are the markup fees billed by the vendor account service provider.

Seller Solutions and also Settlement Gateway Comparisons.

Dharma is a conventional vendor services provider offering interchange plus credit card handling solutions. It is just one of one of the most budget friendly and also clear alternatives for vendors that refine $10,000 to $20,000 in charge card costs monthly. However, Dharma has a $10,000 regular monthly minimum, so it is best for well established services.

Payment Processing Solutions for High Danger Merchants

EMB's Immediate Approval for a Bad Credit Scores Seller Account

In many cases, your vendor account company won't even complete a credit history check prior to authorizing your account. In order to figure out just how much you will certainly need to pay for your services, you ought to contact our client support representatives as well as give us with some info. Apply currently for a high risk seller account and begin processing within 24-hour of being authorized. So "instant approvals" do not exist in the high-risk vendor account world.

Bankcard Solutions Blog

Without this service account, which really functions extra like a line of credit, a seller can not refine and approve credit scores and also debit card deals. Businesses require a merchant account to accept significant charge card by means of a fixed point-of-sale terminal, mobile card reader, or with a virtual payment entrance.

The business sells products or services on a continuity or repeating invoicing version:

- High threat vendor accounts are merchants who have actually been deemed high danger by conventional financial institutions and payment processors.

- Unfortunately, Visit this site it's too simple to get denied http://marcosmqc619.huicopper.com/seller-identification-number a couple of times as well as start seeming like you need to register with any kind of company that will take you.

- He has a Bachelor of Science level from Penn State and also a Juris Doctorate from the Ventura College of Regulation.

Instantaneous Approvals-- it is not possible, immediate authorization for a risky seller account. Such sorts of business requirement complicated documents to get approval for a merchant account from seller acquiring a bank. Banks intend to see a listing of KYC files before they give an authorization.

Get help with account questions, suggestion on bank card viewers and also to establish your on-line credit card processing account. to your escort business will certainly use the first-class comfort for your consumers. Vendor Stronghold supplies escort merchant accounts which are particularly created for online, in-app. Connect with Merchant Stronghold to handle your companion seller account today.

To accept credit cards from your clients, you'll need to open a merchant account. Credit card cpus bill a charge to approve settlement transactions as well as attach deals with your company examining account. Each one those aspects might help you increase your likelihood of obtaining approved Take a look at the site here for a seller account immediately. Concern iPayTotal which supplies instant approval for vendor accounts with the aid of its globally companion network as well as begin raising your own business.

With our group's one-of-a-kind experience in the repayment space, we bring the crucial competence to get your account authorized promptly as well as painlessly. Our team is dedicated to providing unmatched customer care as well as pursue 100% client satisfaction.

Easy Repayment Techniques for your LTD Orders

Its month-to-month charge makes it a pricey option for startups and micro sellers, and for multichannel vendors that require three $99 monthly accounts to manage in-store, on-line, and also mobile sales. Fattmerchant can also be more costly than Square as well as PayPal for companies refining less than $10,000 each month or sellers with a typical purchase below $20. Like all the various other charge card processing remedies on our checklist, Fattmerchant additionally integrates with prominent POS systems like Vend, Shopkeep, as well as others by means of API. Like Payment Depot, Fattmerchant incorporates with Authorize.net for on-line settlements. Fattmerchant additionally has a customized online check out tool so services can create their very own option.

Easy Payment Techniques for your LTD Orders.

Many vendor company additionally use payment handling tools such as settlement portals, point-of-sale (POS) systems, and card-reading equipment. We evaluated loads website of popular carriers to identify the best merchant solutions for small company. A a lot more accurate merchant account definition is a savings account that fronts your company most of the earnings from charge card payments you accept before your clients repay their card issuers. While you do need to be prepared to pay a higher price cut rate than a lot of other people would, in order to open up certain types of accounts, this is a needed sacrifice that requires to be made.

A vendor account is an agreement in between a seller and an obtaining bank. This arrangement enables the former to procedure as well as accept charge card payments. By signing this agreement, a vendor consents to comply with the operating laws established by Visa, MasterCard, or any kind of various other brand. Since it is mainly made for on get more info the internet payments, red stripe is a bit various from the various other credit report card processing firms on our list.

How do I get a merchant account?

The time that it takes for a merchant who accepts a credit card as payment until the time the funds are deposited into the merchant's bank account can vary depending on the type of merchant account the business owner uses. Typically, a payment can take anywhere from 24 hours up to three days to process the payment.

Merchant Expert Frequently Asked Questions

- Your credit scores can identify http://www.pearltrees.com/aureen8crd#item298574184 the discount rate you must pay to refine bank card.

- Fattmerchant makes it easy to approve bank card online by offering repayment options for ecommerce and shopping carts, virtual terminals, and open APIs for custom-made remedies.

- I possess & operate a "blueprint store" and have actually been an exceptionally completely satisfied user of Square for charge card processing As Well As invoicing.

- Each company also uses different hardware options, attributes, as well as different POS and ecommerce assimilation choices.

These settlement processors are willing to accept the liability for the boosted danger connected with those categorized as high risk organisations. The most economical choice is to make use of a typical credit score card processing option based on interchange plus pricing if your service does not call for the wheelchair that Square gives. You will find the lowest rates and fees right here at CardFellow. Simply register to obtain complimentary quotes from several processors. I have a really little business, as well as I process cards for a total of $200 weekly.

Just how do I select a merchant service provider?

What is the cheapest way to process credit cards?

At PayPal, our flat-rate pricing structure is a base rate of 2.9% plus $0.30 per transaction. Visit our fees page to get the full details on our flat-rate pricing.

This has to be approved by the bank's underwriting team. The entire process can take considerable effort and time. All the companies we've profiled here offer superb service at an economical cost, however some are better fit to specific sorts of companies than others.

For a side-by-side contrast of several of the business noted right here (and also a few various other superb service providers), please see our Vendor Account Comparison Chart. As you have actually most likely seen by now, prices for credit card handling is an unbelievably complicated topic. With lots of interchange rates as well as a wild selection of costs, attempting to figure out how much approving bank card is mosting likely to cost your organisation undoubtedly comes down to guesswork. While you can make an affordable estimation based on your handling history and your organisation kind, it's not practical to expect that you'll have the ability to create an accurate figure.